Not known Details About Retirement Planning

Wiki Article

Retirement Planning - An Overview

Table of ContentsThe Basic Principles Of Retirement Planning Retirement Planning - TruthsWhat Does Retirement Planning Mean?The 10-Minute Rule for Retirement Planning

There is additionally a specific benefit of feeling monetarily safe that assists people make much better choices in the present moment. If you do not think it, simply think of just how you may feel if you were greatly in financial obligation (particularly charge card debt). Equally as being trapped under the worry of corrective rate of interest payments makes it difficult to think and also plan plainly, but having a large nest egg for the future will seem like a breath of fresh air during your working years.

There's no pity in depending on member of the family when you truly require them. In America there is an entire range of opinions on proper boundaries with extended household participants and in-laws. You can not (or should not) expect to depend on your kids to take care of you monetarily or in actuality.

It is very important to remember that by the time you retire, your children may have kids of their very own that they require to sustain, which means that if they likewise require to support you, you're putting them right into something famously called the Sandwich Generationa team "sandwiched" between the financial obligation of looking after their youngsters and taking care of their parents.

How Retirement Planning can Save You Time, Stress, and Money.

With a retirement in place, you'll have even more money to give as you get all set to leave a legacy. Having a retirement plan in position may not be things that solutions your marital relationship, however it can definitely assist. As you might presume, national politics, affection, kid rearing, and cash are amongst the greatest instigators of debates in a wedded pair.Don't place the economic safety and security of your golden years off any type of longerroutine a complimentary appointment with an Anderson specialist today! - retirement planning.

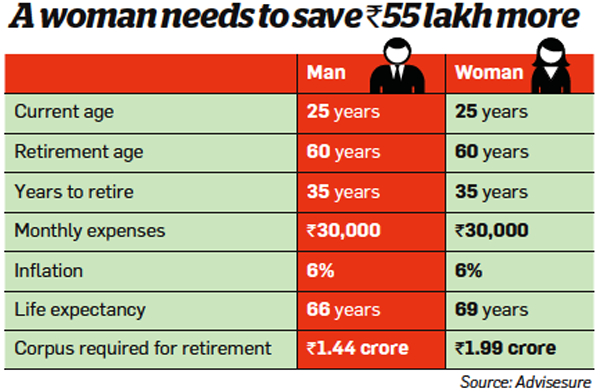

Here are some of the main reasons retirement preparation is vital. Likewise read: 10 Imaginative Ways to Earn Money After Retired Life Inflation is driving the price of living to new heights; today's regular monthly budget will not suffice to cover your weekly budget plan in 25 or 30 years when you retire.

The investments need to be long-term as well as reasonably low-risk that can stand up to economic downturns, like property as well as federal government bonds. Discover more >> Climbing Rising cost of living: Where Should You Keep, Invest Your Cash? While most workers like to function until they hit the mandatory retirement age of 60, often, these strategies can be cut short.

Retirement Planning Fundamentals Explained

You can rollover that understanding to click to find out more other areas of life. As an example, you can duplicate your successful retired life financial investment approaches in your various other spending goals, such as getting a home. It will assist you develop riches and retire abundant. Preparation for retirement will help prepare your estate to line up with your life tradition.

You can maintain your wealth and also leave it to your dependents, who you trust fund will proceed your tradition. Purchasing realty as well as obtaining life insurance policy can leave your dependents economically set after you are gone. Review: What to Do If You Shed Your Earnings Mid-Career? After retiring, the finest thing you can do for your family members is not burden them monetarily.

You ought to be the person aiding your children pay for your grandkid's education as well as such. Depending on your kids monetarily after retirement as well as having them pay "black tax obligation" can substantially prevent their economic growth, creating a generational hardship circle. Even worse, it can add to disunity in the family. retirement planning. Retired life planning will aid you produce safeguard where you will be producing earnings after retired life to sustain yourself and not problem others with your economic needs.

Without enough preparation and financial preparation, it can feel like jail. Preparation for retirement can assist you afford to accomplish things and also attain desires you could not while functioning.

Retirement Planning for Dummies

Report this wiki page